In a nut shell, the idea behind technical and commercial to financial matching, shortened to “matching”, is to ensure all bids are evaluated fairly and on a like-for-like basis. To use the common jargon: “We need to ensure we are comparing apples with apples”.

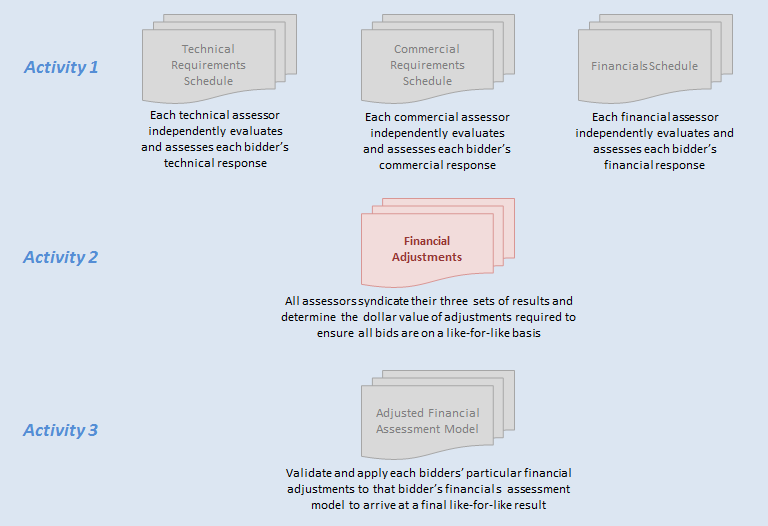

The following diagram shows the process which is described in the text below.

Introduction

The Process

It is common practice for the commercial assessor to complete the commercial and financial evaluation models. So for example, if there were six bidders, four technical assessors and three commercial assessors, we would have 24 completed technical assessment models, 18 completed commercial assessment models and 18 financial assessment models (annotations only).

In preparation for the matching meeting, the assessors need to consider the bidder responses to the financial schedule in great detail. After this detailed examination, they should be in a position to attend the matching meeting to:

- Confirm the degree to which each bidder has been compliant with the RFx in terms of what has been included in the financial schedule

- Articulate what each bidder has neglected to include in their financial schedule which was otherwise required to compare bids on a like-for-like basis

- Articulate what each bidder has added into their financial schedule which was otherwise not required to compare bids on a like-for-like basis

The quality of the outcome of this activity depends largely on the assessors’ knowledge of the required solution, the detailed understanding of how the bidders have constructed their offers to meet the solution, an understanding of discounts and special financial arrangements offered and, in general, a good sense of the business. It comes down to the experience and judgment of the technical, commercial and financial assessors.

At the start of the matching meeting, the procurement manager should remind the participants of the objectives of the meeting and the format that the meeting will take.

The procurement manager should step through each bidder’s Financial Schedule one-by-one and have a set of probing questions prepared. These questions are required to stimulate discussion in the unlikely circumstance that the assessors are reticent.

When the meeting agrees that one of the bidders needs to have an item added or subtracted from their bid, this must be quantified and recorded by the procurement manager for later adding or subtracting, to or from, the Total Cost of Ownership (TCO).

The format of the third activity may vary according to the amount of time available as well as a number of other factors. If there is time and opportunity outside the meeting, the procurement manager should test each set of adjustment with each bidder respectively for correctness and accuracy. The procurement manager should then complete the financial assessment model using the results obtained and validated above.

Outcome

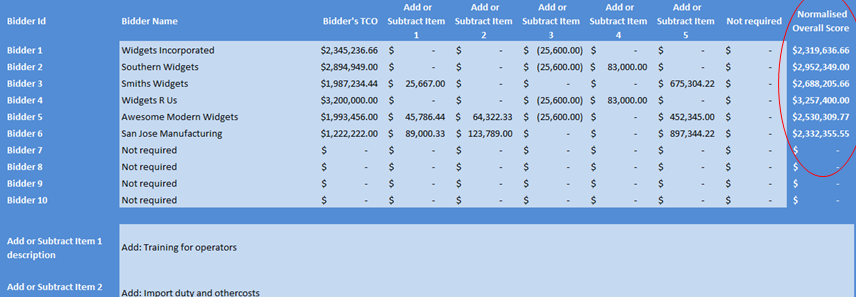

A completed sample is partially shown below.